Get in Touch with hard money lenders in Atlanta Georgia Now

Get in Touch with hard money lenders in Atlanta Georgia Now

Blog Article

Comprehending the Essentials of a Hard Money Finance: Your Comprehensive Guide

Browsing the world of real estate financing can be intricate, particularly when it comes to tough Money lendings. As an alternate type of funding, these car loans play a vital duty in residential or commercial property investment techniques, yet they continue to be shrouded in enigma for several (hard money lenders in atlanta georgia).

What Is a Hard Money Lending?

a Hard Money Loan, typically considered as an economic lifeline, is a particular type of asset-based financing. It is typically issued by exclusive financiers or companies as temporary fundings based upon the residential or commercial property's worth as opposed to the consumer's credit reliability. The residential property concerned can either be a brand-new acquisition or an existing one up for refinancing. The charm of this Funding relaxes on its rate of concern, bypassing the prolonged authorization procedure of traditional loans. Nonetheless, it features higher rate of interest, making it an adventure for borrowers. It's commonly an option of last option for individuals and companies encountering monetary problems. Recognizing its intricacies is critical for making informed economic decisions.

How Does a Hard Money Loan Work?

Ever before asked yourself exactly how a Hard Money Financing functions? Basically, it's a temporary Funding, normally used in property transactions, secured by the building itself. This sort of Finance is predominantly made use of by investors searching for quick financing without the rigorous requirements of typical banks.

In a Hard Money Financing, the consumer gets funds based upon the value of the residential or commercial property, not their creditworthiness. The lending institution, usually an exclusive specific or company, evaluates the home's worth and provides appropriately. The procedure is quicker than traditional financings, commonly finished within days.

Nevertheless, tough Money financings featured higher passion prices and fees due to the enhanced danger. When the debtor can not certify for various other financing alternatives., they are generally made use of for fix-and-flip jobs or.

Contrasting Tough Money Lendings and Conventional Car Loans

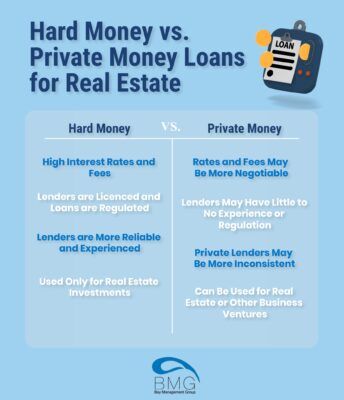

While tough Money car loans and conventional fundings both work as funding choices, they differ dramatically in different facets. Conventional financings, commonly offered by financial institutions or lending institution, typically have lower rate of interest and longer-term payment timetables. They require strenuous credit rating checks and proof of revenue, which can result in an extensive authorization procedure.

On the various other hand, difficult Money fundings are usually provided by personal financiers or firms. The collateral for the Financing is generally the residential property being purchased. This kind of Finance is defined by short-term Finance durations and greater rate of interest. The approval procedure is typically quicker, as it relies much less on the customer's credit reliability and more on the value of the hidden property.

Benefits and Drawbacks of Difficult Money Lendings

Despite their greater rate of interest, tough Money lendings supply a number of noteworthy advantages. Mainly, they are much faster to process than typical fundings, which can be essential for time-sensitive investment possibilities. hard money lenders in atlanta georgia. These lendings are typically based on the residential property's worth as opposed to the debtor's creditworthiness, making them an eye-catching option for those with bad credit report or who require click for more a swing loan

Nevertheless, the drawbacks of tough Money fundings need to not be forgotten. The aforementioned high rate of interest can make these car loans cost-prohibitive for some debtors. In addition, due to the fact that these loans are usually short-term, they may not suit those needing long-term funding. The absence of federal guideline can lead to much less security for consumers, potentially resulting in aggressive lending techniques.

Leveraging Hard Money Finances genuine Estate Investments

Verdict

Difficult Money loans, while pricey, provide a feasible solution for those looking for fast, short-term financing genuine estate purchases and restorations. They are primarily asset-based, concentrating on the building's worth as opposed to the customer's credit reliability. However, their high rates of interest and short-term nature necessitate cautious preparation for settlement. Because of this, recognizing the basics of tough Money car loans is essential for any type of potential genuine estate capitalist.

The charm of this Lending relaxes on its rate of read here issue, bypassing go right here the extensive authorization procedure of conventional fundings. Comparing Tough Money Loans and Typical Financings

Unlike typical financings, tough Money car loans are not primarily based on the customer's creditworthiness yet on the worth of the home being bought. hard money lenders in atlanta georgia.

Report this page